Every quarter, the NBU updates its macroeconomic forecast and publishes it in its Inflation Report. The report contains a lot of useful information, but is primarily intended for professionals. This webpage was set up to make it easier for anyone to learn about major economic events and the NBU’s vision of the Ukrainian economy’s development going forward.

The following is based on the July 2025 Inflation Report.

How is the economy holding up?

The war is a heavy drag on the Ukrainian economy. Russian air strikes are causing a lot of damage to factories, civilian buildings and infrastructure.

Gas facilities have been hit, so Ukraine is producing less gas and importing more. Russia’s terrorist attacks against civilians are forcing them to go abroad. Although migration is not as bad as in previous years, it is still hard for businesses to find workers and grow.

Harvests will be higher than last year but lower than previously expected because of spring frosts and a summer drought.

Despite all this, Ukraine’s economy is slowly recovering. In the first half of the year, the economy grew by about 1% each quarter, thanks mostly to international support. Foreign aid helped the government cover critical budget expenditures (defense, pensions, healthcare, education). This is supporting the economy.

Ukraine will likely receive USD 54 billion in foreign aid this year, a record sum. With so much help coming in, Ukraine will actually be able to set aside a cushion for next year.

Economic growth also relies on power supply. Fortunately, electricity supply is much better this year, which helps production and keeps the economy more stable.

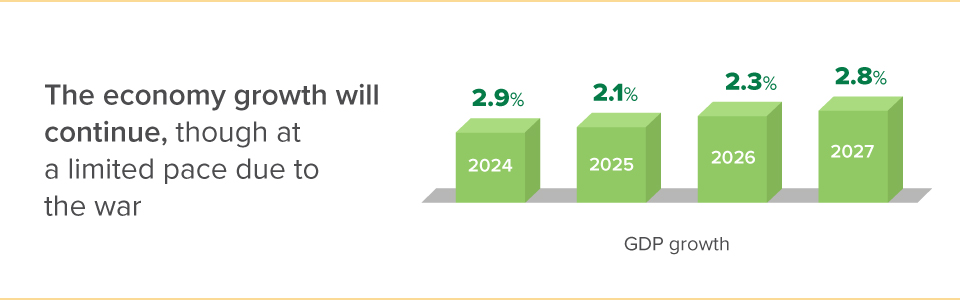

Future growth depends on how the war develops. If the situation remains tense for long, real GDP will probably add no more than 2%–3% a year.

But if things improve soon, growth could be faster. Lower security risks, investments in reconstruction, further European integration and return of migrants will help the economy to grow faster.

What is happening to jobs and wages?

The job market is tight due to the war. A lot of people have joined the Army, many have gone abroad (the UN puts the number of Ukrainians remaining abroad at 5.6 million, according to July data). This makes it hard for employers to find workers.

Businesses say finding skilled workers remains their biggest challenge. Without enough staff, they can’t increase production. At the same time, labor shortages force them to raise wages, which raises costs.

Meanwhile, the labor market situation has been getting slightly better in recent months. More people started looking for work and businesses began to more eagerly hire veterans, retirees, and students. As a result, wages have started growing less rapidly than last year.

But worker shortages are not going away any time soon. So, wages will continue to rise as companies compete fiercely for qualified workers.

Even if peace is quickly restored in Ukraine, after-war reconstruction will also require a lot of skilled workers, making them highly valued.

What about prices?

Inflation began to decline this summer, as the NBU predicted. In June 2025, inflation slowed to 14.3% yoy, and in July to 14.1% yoy. This drop was driven by several key factors:

- new crops, vegetables in particular, arrived in the market.

- tariffs for basic utilities (gas, heat, and power) remained fixed.

- policy of the National Bank of Ukraine (NBU) boosted confidence in domestic savings (more about this in How to Protect Savings From Inflation below), which helped to curb demand for foreign currency and keep the foreign-exchange market sustainable.

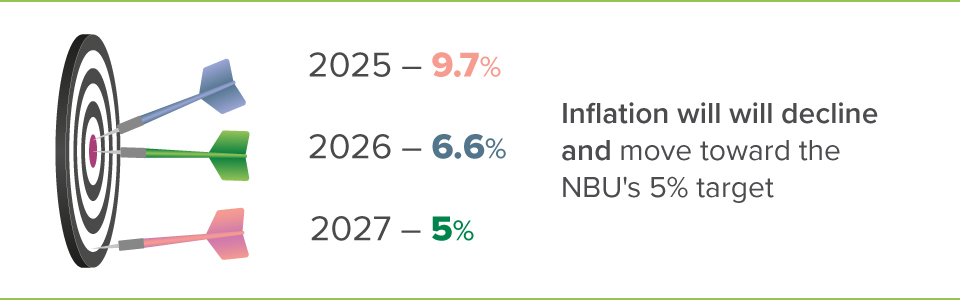

The NBU expects that inflation will continue to decline: below 10% at the end of this year, to 6.6% in 2026 and finally toward the 5% target by the end of 2027.

Rising crop yields and more steps by the NBU will help drive inflation down.

Surveys are showing that businesses, households, and experts are also expecting inflation to slow down.

How to protect savings from inflation?

To safeguard hryvnia savings from inflation, the NBU keeps its key policy rate at 15.5%. This encourages banks to maintain a fairly high return on hryvnia deposits.

Many banks are currently offering interest rates between 13% and 16% on hryvnia deposits with maturities ranging from 3 to 12 months. After taxes, depositors can expect an annual return of approximately 10% to 12%.

Buying domestic government bonds is another effective way to protect savings. These bonds offer annual yields between 14% and 18% (depending on maturity), and the income is tax-free.

Such returns are meeting investors’ needs. The recent increase in hryvnia savings is the best evidence that investors are happy. From January to July 2025, retail hryvnia deposits with maturities of at least three months grew by over UAH 20 billion, and investments in government bonds rose by nearly UAH 17 billion. This indicates strong investor confidence in hryvnia assets.

Polls have shown that households expect inflation to be about 10%–11% over the next 12 months. As a result, they are willing to buy hryvnia assets, anticipating that the returns will outpace inflation. Consequently, demand for foreign currency has decreased in recent months.